- 15 045 m2

Monthly Costs

Monthly Bond Repayment ZAR .

Calculated over years at % with no deposit. Change Assumptions

Affordability Calculator | Bond Costs Calculator | Bond Repayment Calculator | Apply for a Bond- Bond Calculator

- Affordability Calculator

- Bond Costs Calculator

- Bond Repayment Calculator

- Apply for a Bond

Bond Calculator

Affordability Calculator

Bond Costs Calculator

Bond Repayment Calculator

Contact Us

Disclaimer: The estimates contained on this webpage are provided for general information purposes and should be used as a guide only. While every effort is made to ensure the accuracy of the calculator, RE/MAX of Southern Africa cannot be held liable for any loss or damage arising directly or indirectly from the use of this calculator, including any incorrect information generated by this calculator, and/or arising pursuant to your reliance on such information.

Property description

R19,000,000 | PLUS VAT | 15,045 m²

THE OPPORTUNITY IN 10 SECONDS

- 220 units already approved (Government Gazette published)

- Shovel-ready – all zoning, consolidation and density rights in place

- GDV potential: from R121M to R143M - conservative to optimized

- High rental demand area – strong absorption guaranteed

THE NUMBERS THAT MATTER

What You Get

Approved Units - 220 units Total - 58 plus 162

Land Cost - R19M Plus VAT

Est. Build Cost - ±R85M @ R8,500/m²

Conservative GDV - R121M at R550k per unit average

Optimised GDV - R143M at R650k per unit average

Potential Profit - Between R12M and R23M depending on sales strategy

ROI - 10% to 19%

OR Hold as Rental Portfolio:

- Gross rental income: R14.5M/year

- NOI after expenses: R10.2M/year

- Portfolio value at 11% cap rate: R92M+

WHY THIS WORKS

1. FULLY APPROVED RIGHTS

- Published in Government Gazette (Notices 263 & 264, 2009)

- Section 82(1) certificate issued

- Consolidation completed (SG Diagram 13073/2007)

- No rezoning required – move straight to construction drawings

2. BRITS IS BOOMING

- Strong industrial and mining employment base

- High demand for secure, affordable housing

- Limited competition in high-density approved sites

- Excellent rental absorption (4,800–6,200/month achievable)

3. MULTIPLE EXIT STRATEGIES

- Sectional title (sell-off units)

- Build-to-rent (long-term income)

- Hybrid model (sell some, rent some)

- FLISP/GAP housing (government-backed demand)

4. INFRASTRUCTURE READY

- Water and sewer connection to site

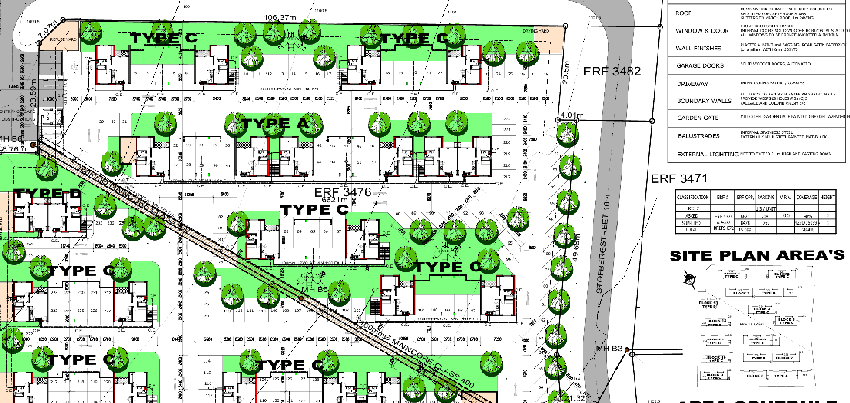

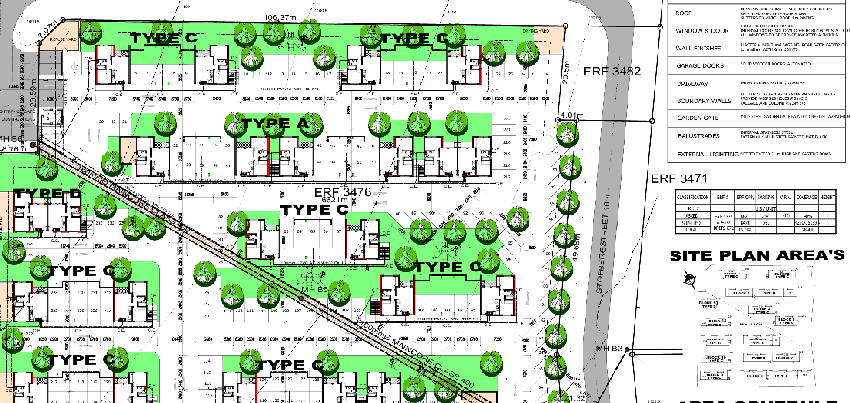

- Gated community layout approved

- Internal roads and extensive parking designed

- Each unit includes private balcony

DEVELOPMENT BREAKDOWN

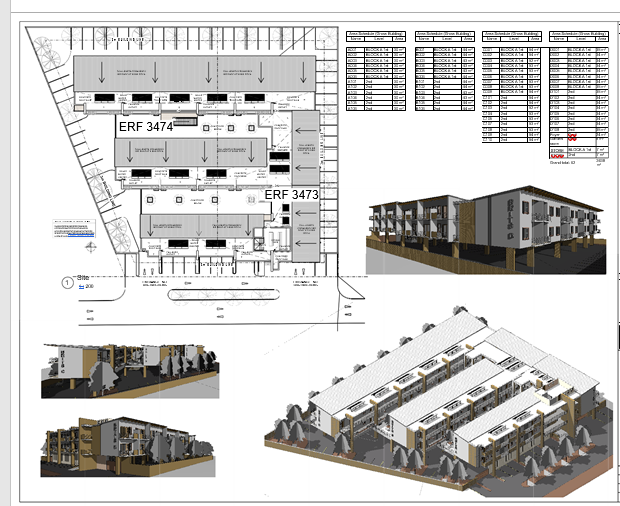

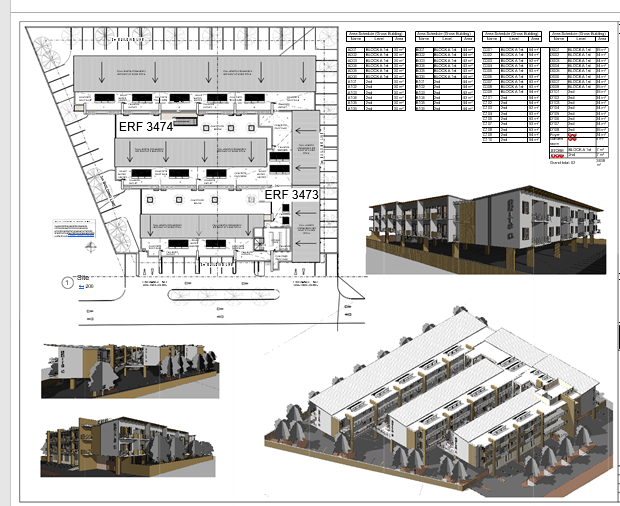

Erf 4854 (consolidated 3473 and 3474) total 58 Units | Approved PC3.0544 (Aug 2007)

Erven 3476 and 3477 total 162 Units | Approved PC3.0831 (Dec 2008)

Total: 220 Units across multiple blocks

LOCATION ADVANTAGES

Brits Central positioning means:

- Major transport routes nearby

- Close to retail centres, schools & hospitals

- Walking distance to employment hubs

- Perfect for rental market (mining, services, industrial workers)

COMPLETE DOCUMENTATION AVAILABLE

All paperwork ready for due diligence:

- Government Gazette notices

- Township proclamation and Section 82(1) certificate

- Consolidation approvals and SG diagrams

- High-density approval letters

- Service connections (water and sewer)

- Architectural concept layouts

IDEAL FOR:

- Residential developers seeking approved sites

- Build-to-rent funds and property portfolios

- Affordable housing specialists (GAP/FLISP market)

- Pension funds seeking stable rental income etc.

This is a genuine, shovel-ready opportunity with all approvals in place.

Price: R19,000,000 Plus VAT

Erf Size: 15,045 m²

Units: 220 (fully approved)

Location: Brits Central, North West

Full development prospectus, financial models, and all supporting documentation available upon request. Developer site visits

arranged by appointment.

Property Details

Property Features

| Erf Size | 15 045 m2 |